opASF (Options ASF)

This is ASF, with Options.

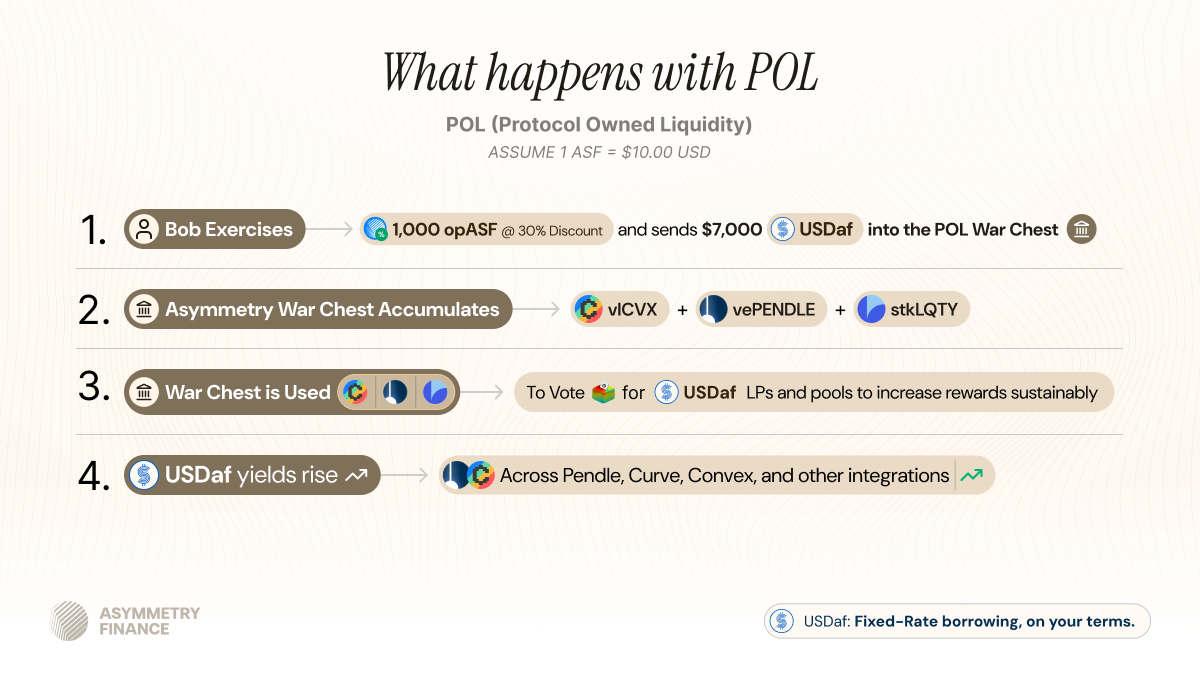

It’s time to build the Asymmetry War Chest of Protocol Owned Liquidity.

Introduction

In 2025, when you walk into a store, you’re used to having options lining the shelves. Endless customization, possibilities, and choice.

In 2025, when it comes to Governance Tokens, there’s rarely any variety. It’s like walking into a store and seeing the same box of chips over and over and over… and they’re stale.

Very few of them bring real value to the protocol, users, and ecosystem at large.

opASF changes that.

TL:DR (Summary):

How it benefits the user:

Two steps:

First, opASF can be distributed as a reward for incentive programs (e.g. a new Asymmetry product, or on a new chain). Alternatively, opASF can be bought in the open market, often at a heavily discounted rate to $ASF.

Secondly, the user can redeem their opASF for $ASF by choosing their desired unlock time (correlated to discount), and use USDaf to complete the purchase, the user will receive their ASF at net discount after their lock period. Allowing users to effectively 'go long' on $ASF, at their chosen discount/timeframe.

How it benefits the protocol:

opASF is Asymmetry’s reward derivative, modeled after Euler’s massively successful rEUL campaign and is designed to build the Asymmetry ‘War Chest’, aka Protocol Owned Liquidity of productive + revenue generating assets (vlCVX, vePENDLE, staked LQTY) that allows Asymmetry to own and sustainably support its ecosystem into perpetuity, rather than renting liquidity.

In other words, the capital generated from opASF goes directly into effective assets that support Asymmtery products for long-term sustainablity (e.g. yield incentives for the AF Curve Stable LP, beneficial for looping USDaf).

The Problem: Bribing is a profitable opportunity, at what cost?

In DeFi today, protocols use their governance tokens to incentivize certain behavior, often with the objective to increase financial upside if users stake/mint/deposit on their platform.

But at what cost?

It’s a cat and mouse game. The protocol must allocate tokens to try and grow faster than the cost of the incentive program itself, then pray that the users that have deposited actually like the product and stick around, even after the additional incentives have dried up.

However, time and time again, it is clear that this model is ineffective for the majority of protocols. Marc Boiron, CEO of Polygon, wrote a piece in CoinTelegraph here. Rampant liquidity mining attracts mercenary capital, all while destroying token ecosystems. Simply put, that’s not sustainable.

There are a number of big name examples of this. Huge incentives to start out that attract a ton of capital. Then as the incentives fade, so does the capital. One big L1 example of this is Blast, shown below. There was no additional marginal utility that Blast brought beyond it being a place to farm, so the TVL faded as the incentives faded.

Specifically within the liquidity-rich Curve and Convex ecosystems, there are incentives (aka ‘bribes’). veCRV and vlCVX holders who do not have an allegiance to a specific protocol can instead ‘rent out’ their votes to the highest bidder, with great effect, averaging 20%+ paid out to vlCVX holders even through the deepest of bear markets — Users that’ve deposited into Asymmetry’s afCVX already know this game quite well.

Bribing is a game played by protocols, all trying to grow liquidity on Curve, where all stablecoin roads lead to. In addition, bribing is often more efficient than just emitting tokens to users, as often more than $1 of CRV emissions are directed towards a given per $1 of token value.

In the last Curve round (98), protocols received $1.77 (!) in incentives for every $1 spent, as shown on Votemarket below.

Yes, you read that right. A 77% boost for bribing through the Curve ecosystem instead of directly giving that money to users via liquidity mining.

This is incredibly efficient at face value, but there is a tradeoff. Bribes are like your buddy’s ex-wife with a spending problem — every 2 weeks, she’s back for more.

Bribes are a never ending hamster wheel that protocols must continue to run week after week. Effectively, swapping their native token for CRV emissions so that users will provide liquidity, which leads to more TVL, which leads to revenue and growth, and the cycle repeats.

But it’s a two way street… What goes up (TVL) can also go down, when those sweet rewards dry up.

Andre Cronje covered this in a blog post that is excerpted below, pointing out a similar path and crossroads that’s been discussed in this article thus far:

As liquidity mining grew, some, non deal-breaking, flaws became apparent. I believe the following two to be the most destressing;

Liquidity locusts (or loyalty), also referred to as “stickiness”

Token loyalty, or opportunistic dumping

Liquidity quickly disappears when incentives cease. — Andre Cronje

Success Case: Euler

The most recent (and most successful) case of creating protocol aligned incentives is Euler. Coming back from the hack, Euler launched and TVL was stagnant to start.

Then they unveiled rEUL, a reward style derivative token of EUL, given to users who participate in the ecosystem with a vesting schedule that spans over 6 months. Euler acquired ~450x the rewards spent in TVL. In other words, for every $1 in rEUL rewards distributed, ~$450 was deposited.

TVL compounded ~80 % MoM for five straight months on just $2.9m of spend.

Can you spot the moment where v2 launched, and then can you spot the moment that rEUL rewards started?

Hint: TVL goes vertical from that point onward.

One feature that often goes unnoticed from the rEUL rewards program is that as users deposit, each user has their own vesting schedule. This means that sell pressure from rewards are spread over a greater timeframe. No singular unlock events.

More detailed analysis on Euler’s highly successful rewards program can be found here.

Andre had the theory. Euler put it into practice with great effect. But what if we took it one step further with game theory and the creation of a War Chest?

The Solution: opASF

What if instead of hopping on the proverbial hamster wheel, a protocol used emissions to build a ‘War Chest’ of Protocol Owned Liquidity (POL)?

POL creates a sustainable flywheeling bag (Asymmetry’s War Chest) that continues to reward users in the ecosystem. That entrenches the protocol with sustainable liquidity that grows the protocol into perpetuity.

This is the objective of opASF.

The Solution: How does opASF work?

Instead of bribing or liquidity mining purely with ASF, Asymmetry will use opASF.

opASF works like an In-The-Money call option on ASF. What does that mean?

opASF is a derivative of ASF.

opASF is always 1:1 redeemable for ASF at a discount. However, opASF is not instantly redeemable for ASF.

When redeeming opASF for ASF, users will select a lock time. The longer the lock time, the greater the discount.

The minimum discount is 10%. The maximum discount is 50%.

The minimum lock time is 30 days. The maximum lock time is 52 weeks.

Most users will receive opASF from Community Rewards (mostly LPs) programs across Curve, Convex, Pendle, Liquity, and more. However, users can purchase opASF from the open market at any time, if they wish to do so.

If a user wishes to have instant liquidity without exercising, opASF can be sold on the open market at any time.

opASF can only be exercised by using USDaf. If a user doesn’t have USDaf, they can zap into it seamlessly from any currency with CoW Swap

Users can exercise opASF to receive ASF at a discount, correlated to lock duration.

opASF also grants veASF for the duration of the unlock period, granting the user governance power and, subject to governance, revenue sharing.

Adopting the same mechanism as Euler, opASF also has a similar system in which each position has its own vesting schedule. This means that sell pressure from rewards are spread over a greater timeframe. No singular unlock events.

Most importantly, all revenue accrued from opASF will be used to acquire revenue generating, productive assets that will form the Asymmetry War Chest.

Initially, the only assets whitelisted are vlCVX, vePENDLE, and staked LQTY. Additional assets can be voted upon via Governance in the future. The rationale behind vlCVX, vePENDLE, and staked LQTY is simple: All assets play a role in funnelling liquidity directly into the Asymmetry ecosystem into sustainable perpetuity.

How does opASF work in practice?

Bob receives 100 opASF because he has been voting for USDaf pools using his vlCVX

Bob comes to the Asymmetry DApp to exercise his opASF

Bob selects a 6 month lock time with a 30% discount. The ASF that Bob can redeem his opASF for is worth $1,000 today

Bob uses $700 USDaf from his wallet to exercise his opASF. Bob notes his ASF strike price of $7.00. Bob receives 1,200 veASF and a sizeable Gem Bonus

In 6 months, ASF is trading at $11. Bob returns to the Asymmetry DApp and claims his 100 ASF worth $1,100, profiting $400 (57%) even though ASF only went up 10% and he only chose a 30% discount.

The Bottom Line: Asymmetry in Control

opASF brings a common-sense principle from the world of traditional, revenue generating businesses outside of crypto. To put it into other words: If you are creating a business that needs bananas in perpetuity, would you rather rent the banana trees, or own them?

In crypto terms: Would you rather the protocol emit ASF via unsustainable bribes forever, or invest in assets that allow the protocol to control and direct the necessary liquidity into perpetuity, all with the end goal of weaning off ASF emissions entirely, ultimately benefitting holders?

Many protocols follow Protocol A’s lead below. Asymmetry will follow Protocol B.

This mechanism also rewards long term believers in the ASF ecosystem. If a user believes that ASF is undervalued and wants to align for the long term, then purchasing opASF from the open-market could make a lot of sense, depending on the discount available. In addition, a user purchasing opASF receives instant veASF (Governance) + a Gem Boost.

Why should I care?

If you’re an ASF holder reading this, why should you care? The answer is simple. It means Asymmetry is optimizing up for long term success. A real revenue-generating, self-sustaining, long-term protocol learning lessons from others that came before it.

Users win, and the protocol wins by amassing productive assets. Win-win. Full circle.

No more cat-and-mouse games.

opASF Contracts/LPs

0x7fE24F1A024D33506966CB7CA48Bab8c65fB632d

https://www.curve.finance/dex/ethereum/pools/factory-twocrypto-237/deposit

Last updated